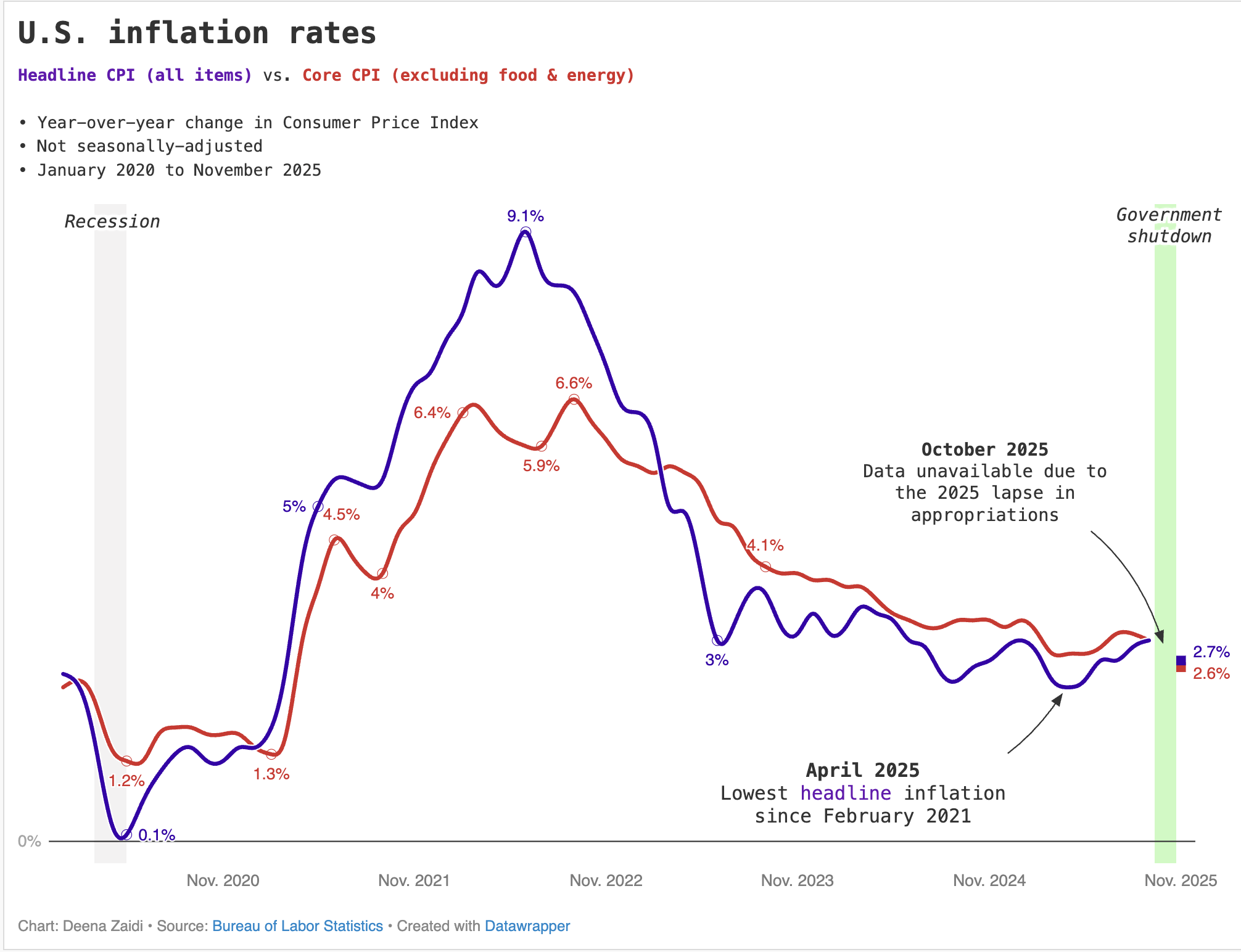

U.S. inflation cooled sharply in November, but the headline number comes with a major caveat.

Data calculated for the November consumer price index (CPI) cannot be interpreted as part of the official CPI series due to the disruption in data collection from the government shutdown that lasted for over 40 days.

BLS said the calculation is based on two data points and not on CPI’s aggregation method.

What the headline shows

November CPI rose 2.7% from a year earlier, well below economists’ expectations for a 3.1% rise. “Core” inflation used to gauge underlying inflation after stripping out volatile items like energy and food prices, rose at an annual rate of 2.6% from 3.1% as reported

Why the data are unusual

The BLS collected prices on November 14 but was unable to gather October 2025 reference-period survey data.

The lack of an October report meant no month-over-month rate report was released for tracking overall inflation, providing an incomplete picture.

Since the Bureau could not collect the October survey data, it filled the gap using “non-survey data sources” for portions of the index. The November 2025 indexes were calculated by comparing November prices directly with October prices.

“There were some special factors or practical factors that really are related to the fact that they weren’t able to collect data in October and not in the first half of November,” John Williams, president of the New York Federal Reserve said on CNBC’s “Squawk Box.”

Missing data points

The BLS explicitly noted the missing data points key in collection for CPI index.

The gaps were largely due to the unavailability of October CPI numbers owed to the 2025 lapse in appropriations.

Several CPI components — particularly more volatile categories such as apparel, household furnishings and operations, and fuels and utilities — could have been affected, raising the risk that the November reading may distort underlying inflation trends.

The bottom line

November’s inflation slowdown looks encouraging — but policymakers, markets and consumers are treating these figures with caution. The number reflects methodological constraints, and December numbers will provide better reading of the level of distortion in the released figures.