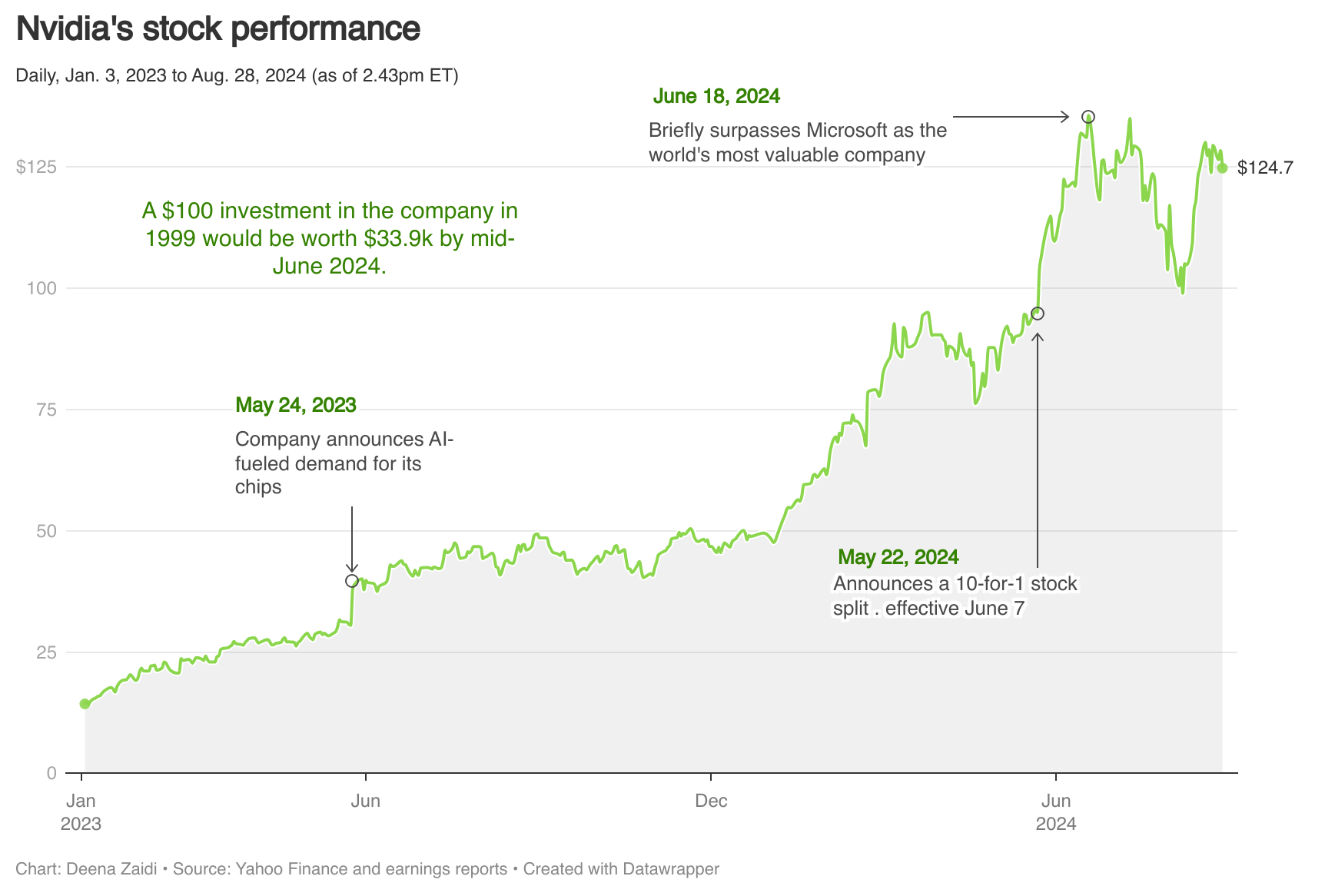

From graphics chip maker to AI leader, Nvidia is one of the world’s most valuable publicly traded companies after briefly surpassing Microsoft and Apple. We look at the stock’s journey in two charts

Data and Financial Journalist

From graphics chip maker to AI leader, Nvidia is one of the world’s most valuable publicly traded companies after briefly surpassing Microsoft and Apple. We look at the stock’s journey in two charts

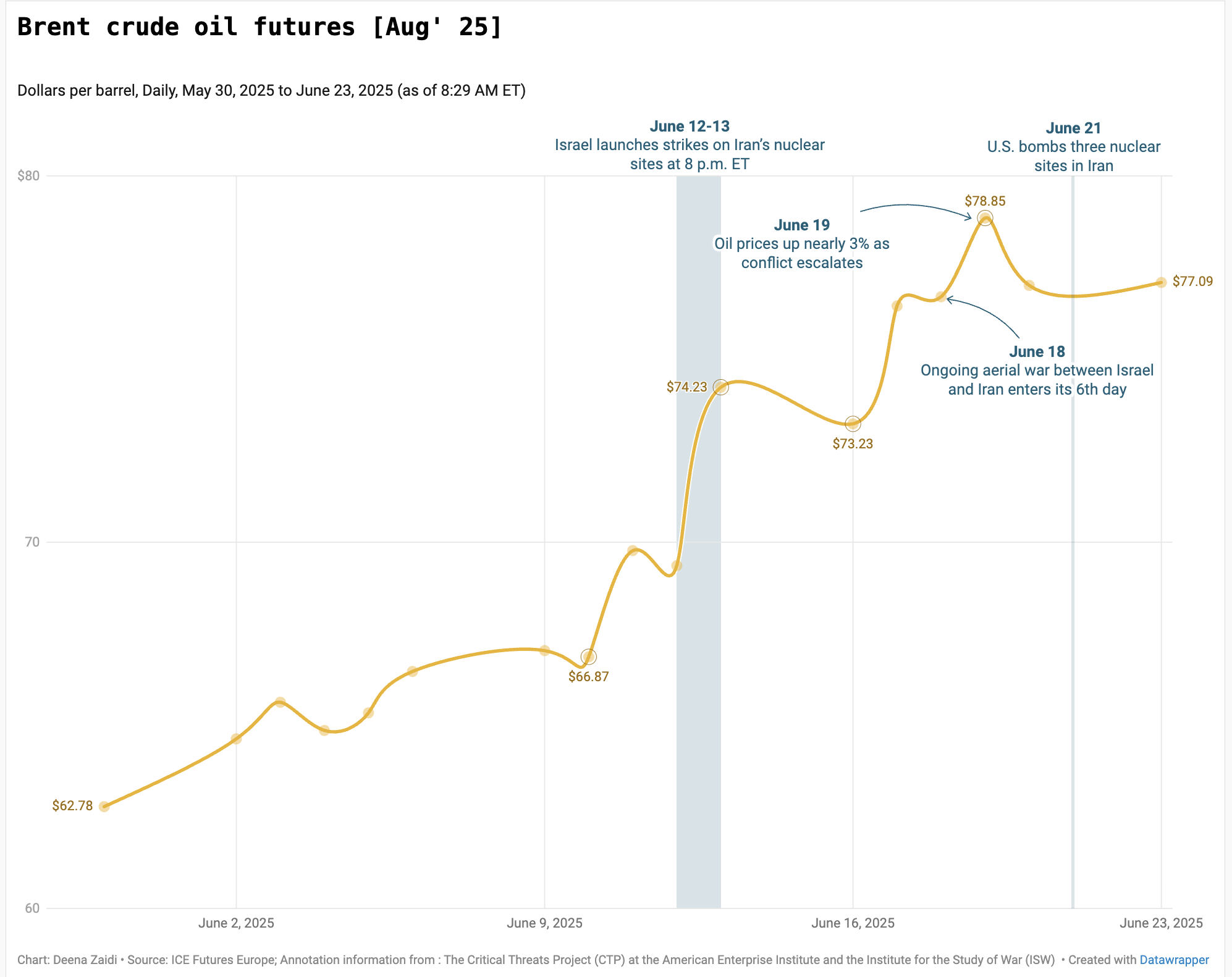

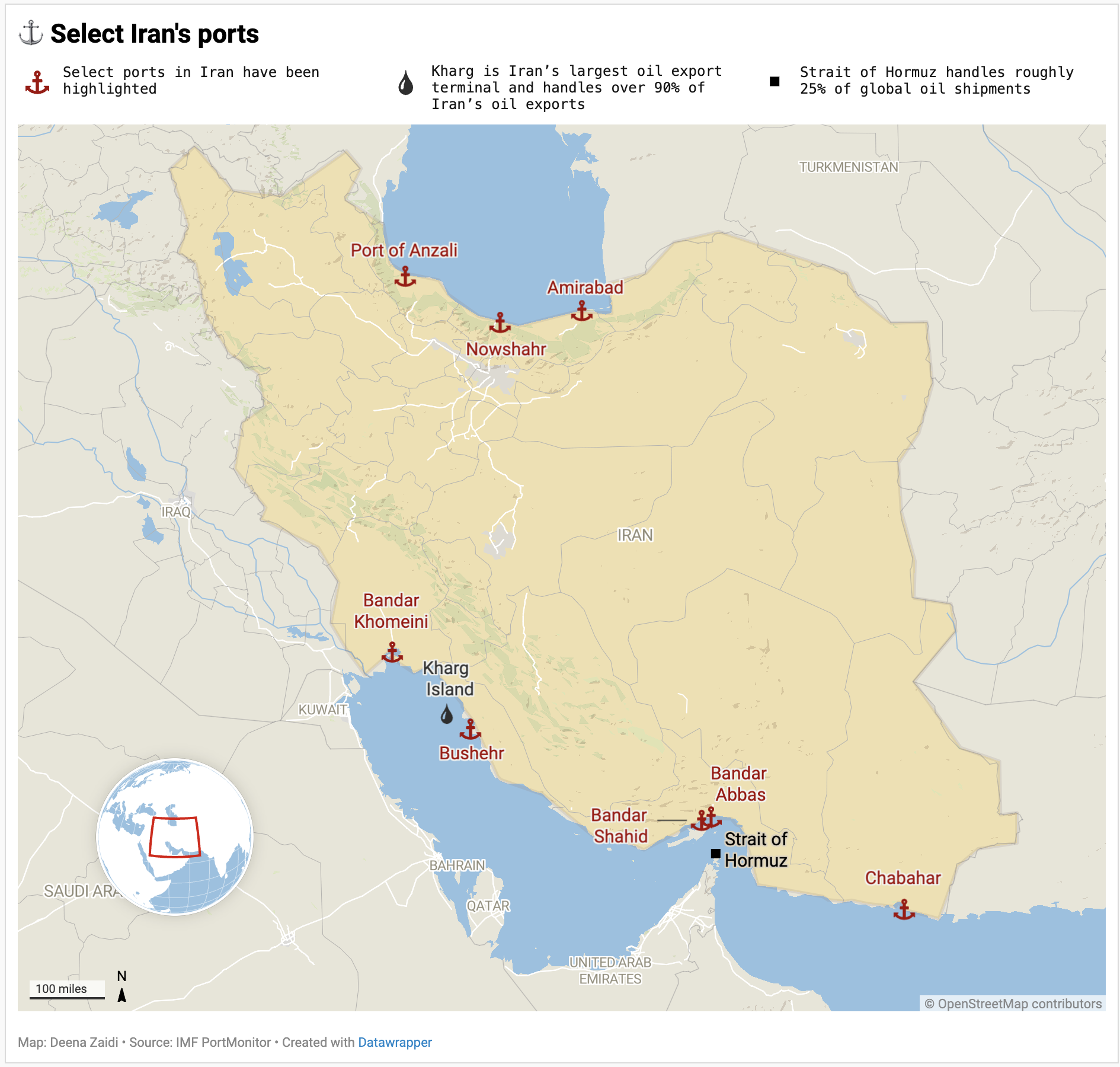

Roughly 20% of global oil and LNG flows through the Strait of Hormuz—making any disruption a potential shock to global energy markets.

Israel’s strikes on Iran’s strategic sites have sent Brent crude and gold prices sharply higher, while potential threats to Kharg Island and the Strait of Hormuz chokepoints could force shipping reroutes, risking wider global supply-chain disruptions.

April’s trade deficit plunged from a revised $138.3 billion in March to $61.6 billion, driven by a 16% drop in imports that reversed the pre-“liberation day” spike.

The ECB cut its key rates by 25 bps effective June 11 after lowering its 2025 inflation forecast to 2%, with core inflation near target and modest GDP growth expected, but also cautioned against rising tariff uncertainty.

Three interactive maps visualizing Trump’s travel bans on 19 countries. Data is collected from DHS visa overstay rates 2023 for all countries (excluding Canada and Mexico) under B1/B2 and F/M/J categories

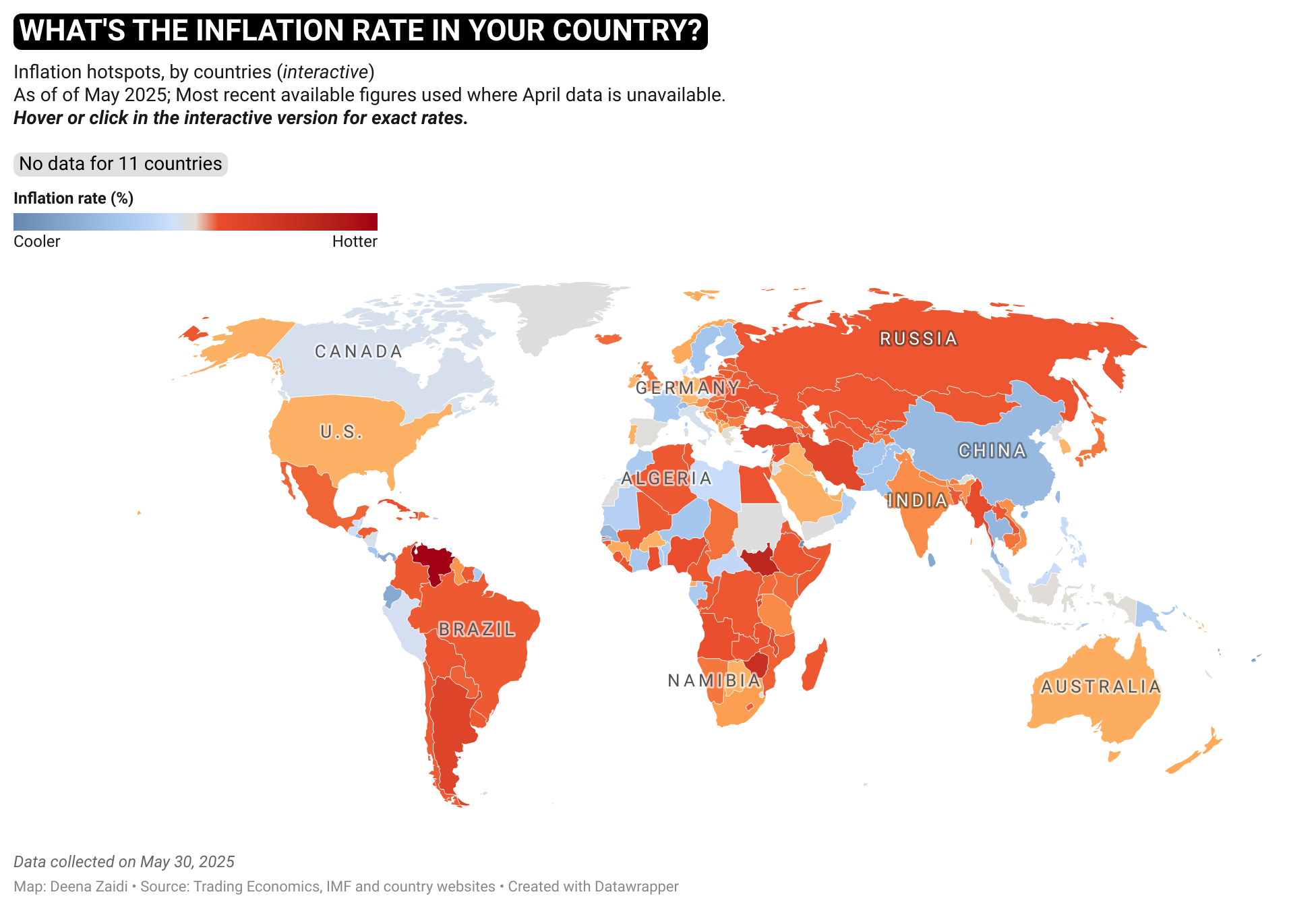

From hyperinflation in Sudan to unexpected price pressures in Japan, explore a map highlighting the most recent inflation rates by country — using May 2025 data where available and the most recent data otherwise.

In Japan, the only Asian economy in G7, core inflation rose at its fastest annual pace in over two years, climbing to 3.5% in April, according to data released Friday. I mapped the inflation (with some caveats) to look at the overall inflation trend in G7 economies.

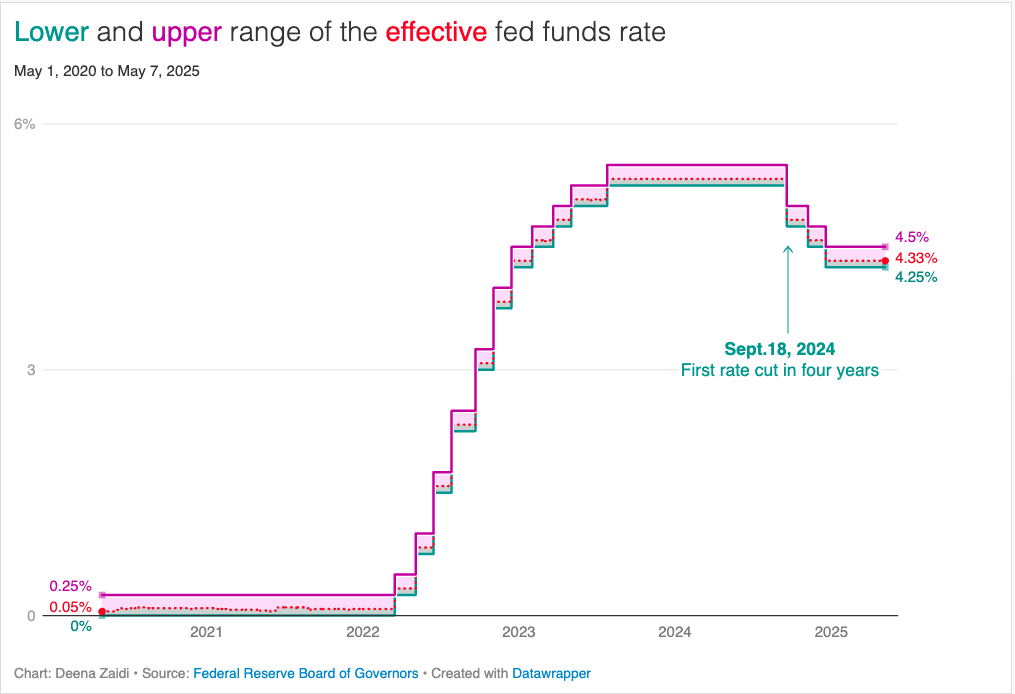

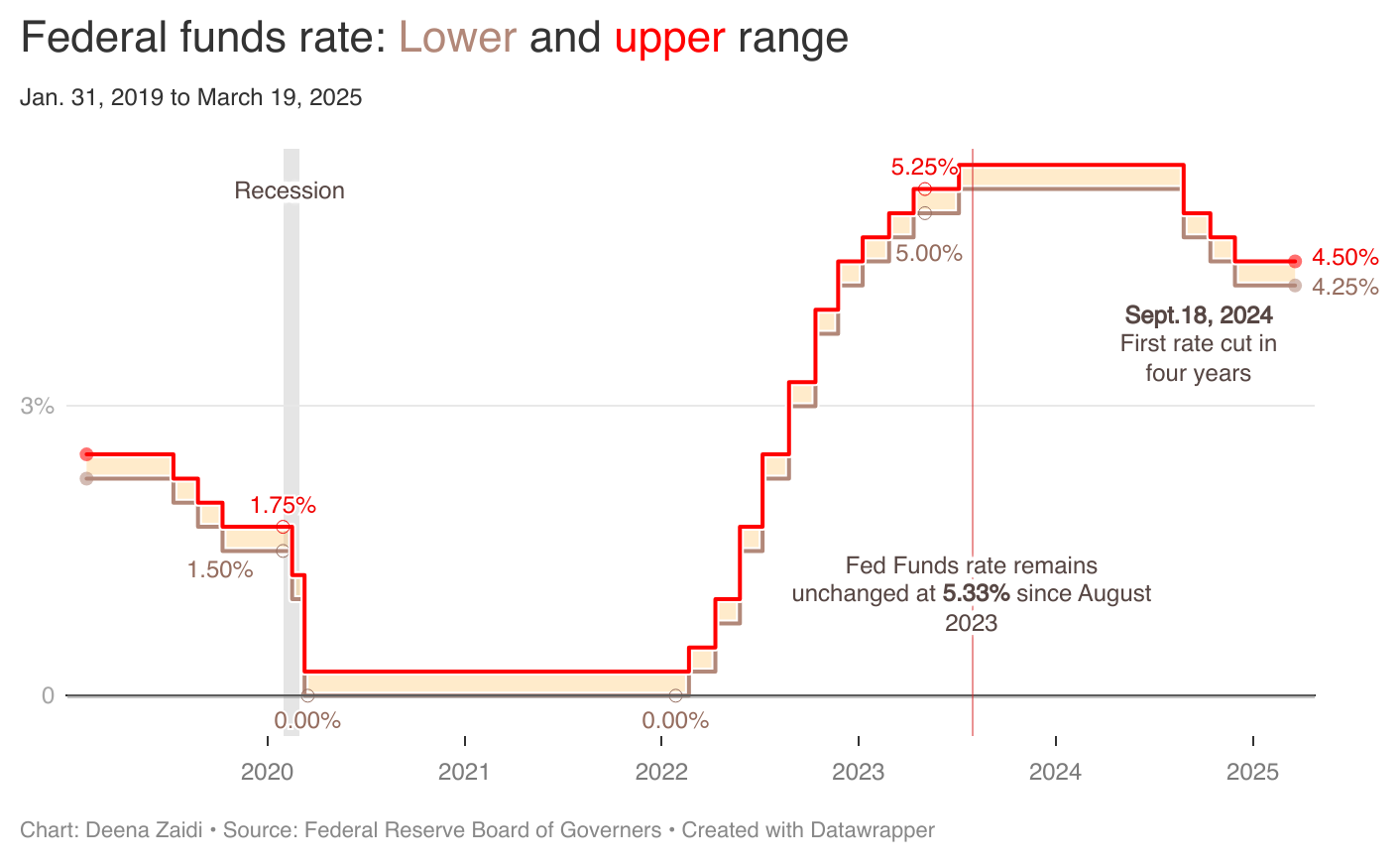

Inflation fell to 2.3% in April. The Fed is keeping rates steady at 4.25%-4.5% as new tariffs fuel inflation risks, prompting a cautious wait-and-see approach.

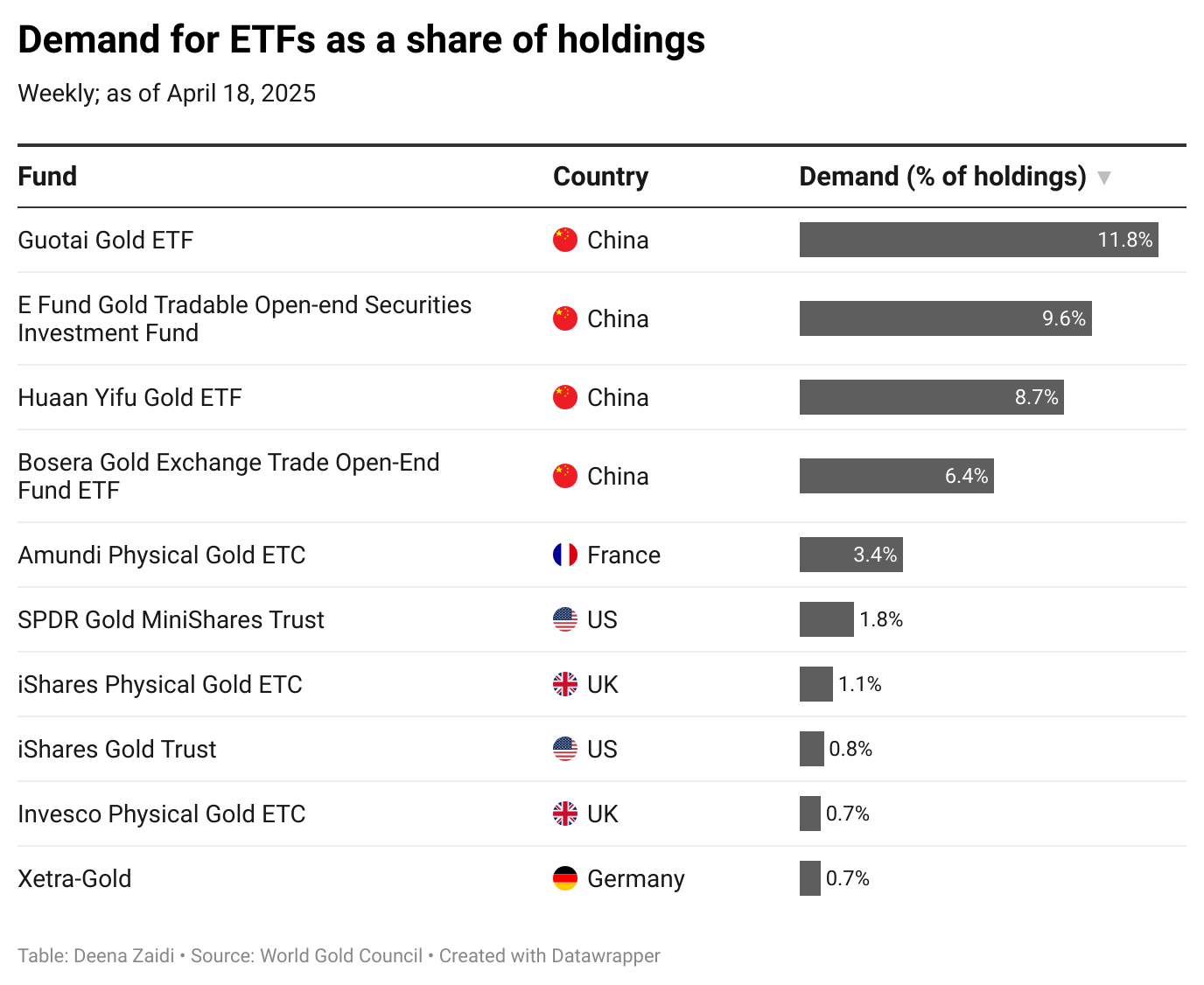

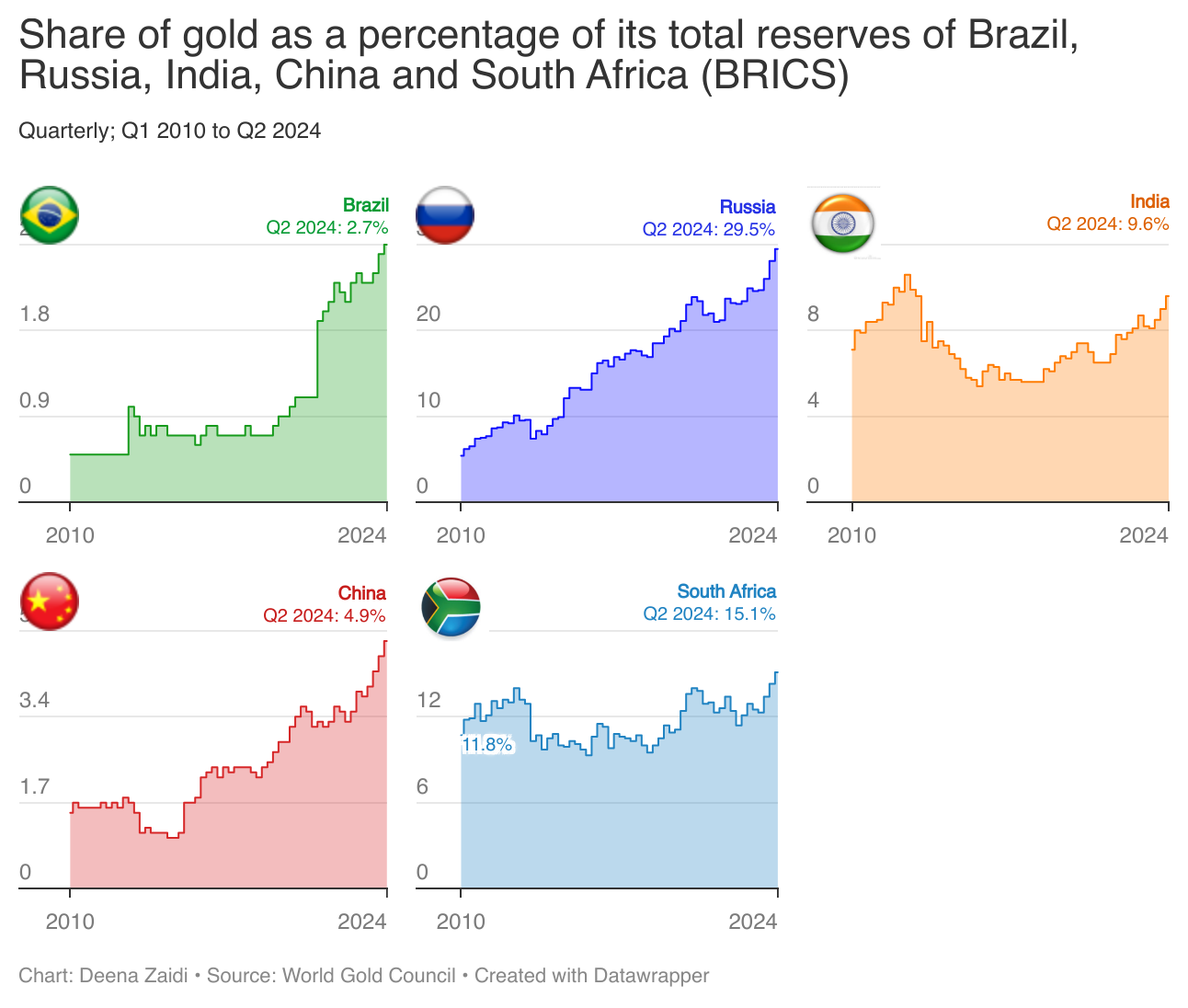

Gold investment demand jumped 170% in Q1 2025 — the highest since early 2022 — driven by record ETF inflows, rising economic uncertainty, and strong buying in Asia.

China is weighing plans to establish overseas warehouses for the Shanghai Gold Exchange, in a move to boost international settlement of yuan-denominated gold contracts and expand the global use of its gold benchmark.

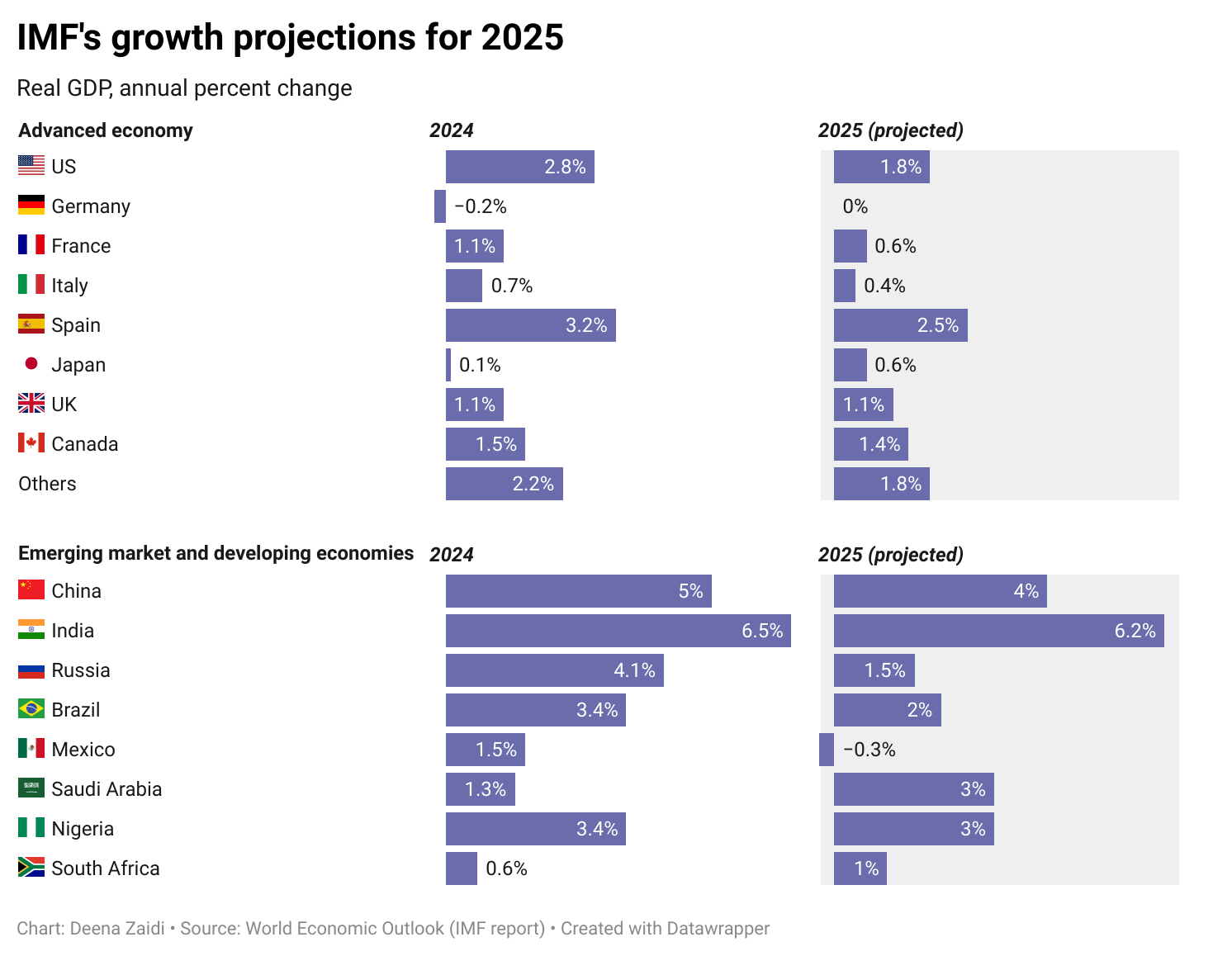

IMF issued its steepest downgrade for the U.S. among advanced economies, citing rising tariff-related uncertainty and a heightened risk of recession. Global economic sentiment has dimmed, with the IMF now projecting a 37% chance of a U.S. downturn—up sharply from 25% just months ago.

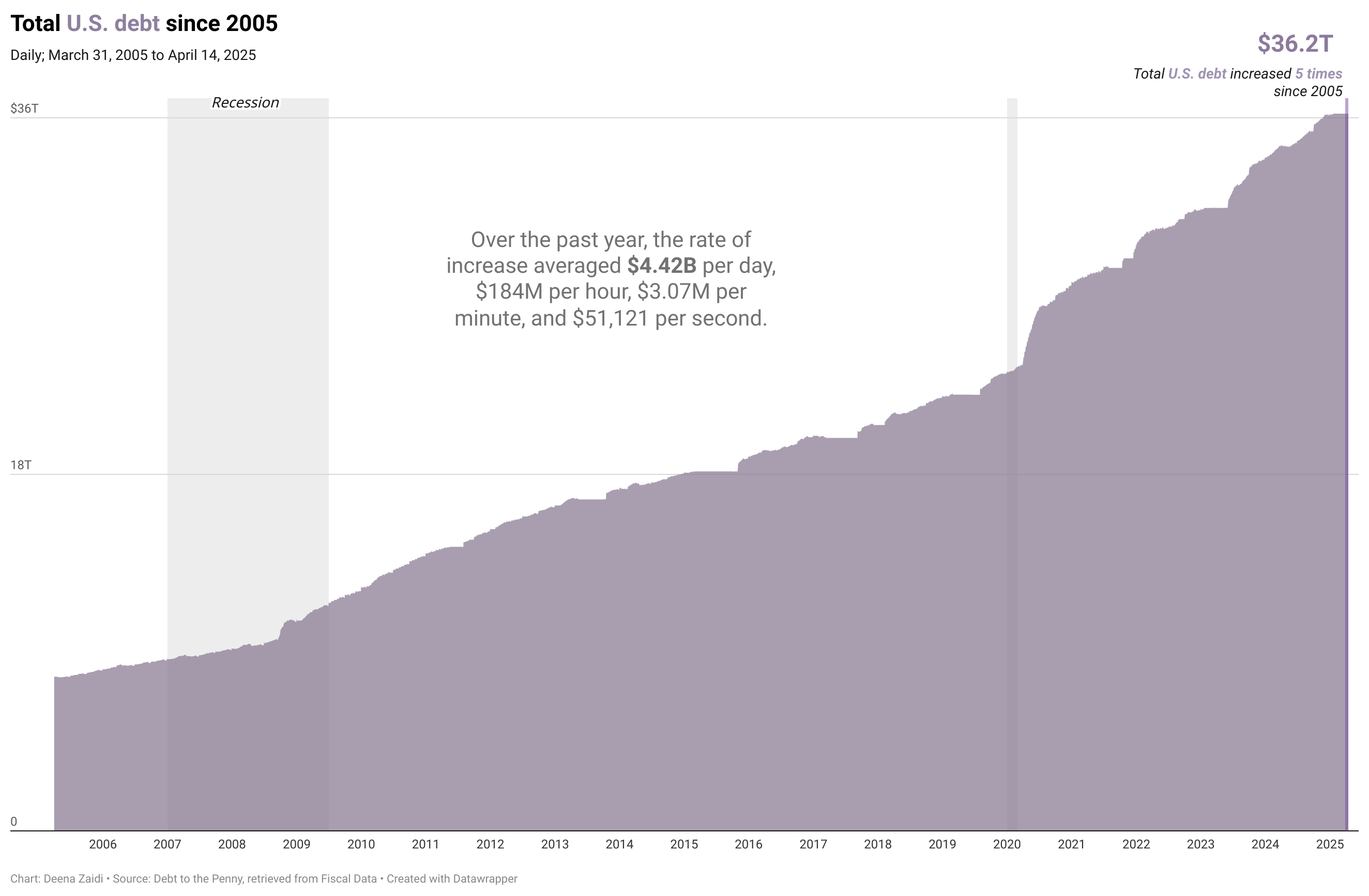

Foreign investors held $8.8 trillion in U.S. Treasuries as of February 2025—a 10.2% increase from a year earlier, according to the recent U.S. Treasury data. Japan, China, and the U.K. remain the top holders of U.S. debt. Two charts show the major foreign holders as the national debt hits $36.1 trillion.

President Trump’s new tariffs hit Asian exporters the hardest. With a 90-day pause in place, countries like Vietnam and Cambodia seek trade solutions amid rising U.S. trade deficits.

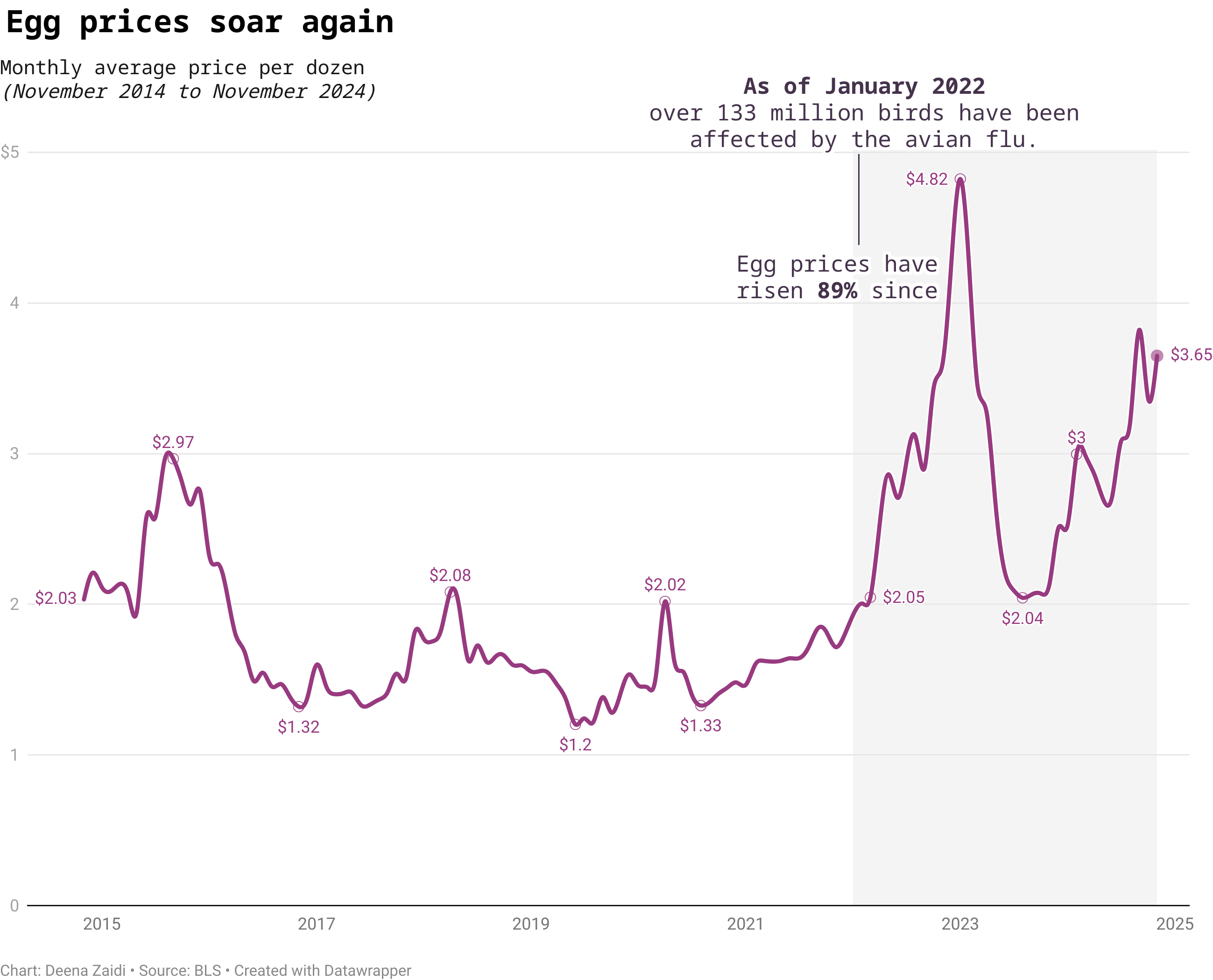

U.S. inflation dropped to 2.4% in March as consumer prices fell slightly, easing from 2.8% in February. The dip comes amid new tariffs from President Trump and ongoing Fed caution on interest rate cuts. Food prices, however, continued to rise—egg prices surged 60.4% year-over-year.

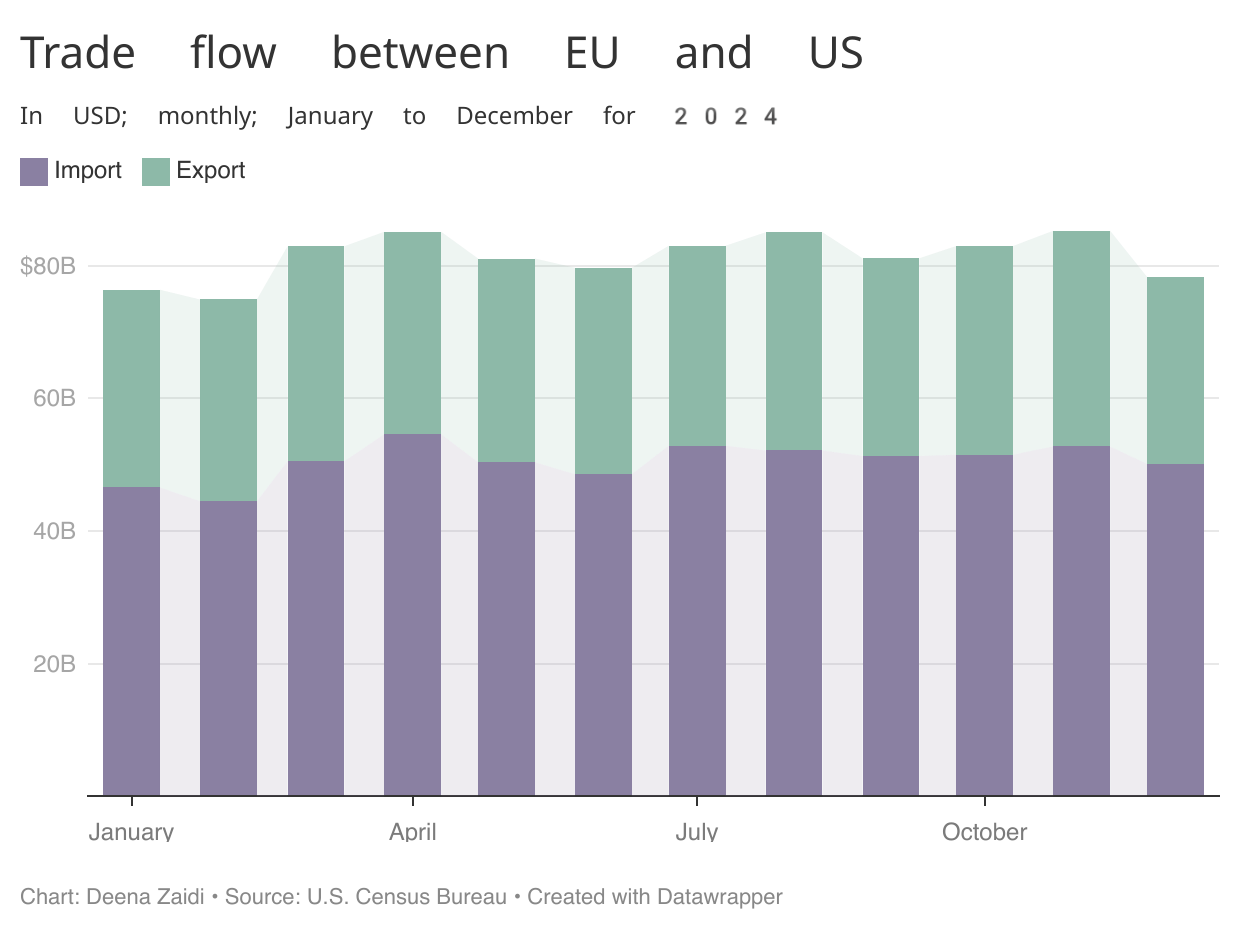

The U.S. reported major trade deficits in February 2025 with China, the EU, and Mexico—just as President Trump’s latest round of ‘reciprocal’ tariffs took effect. Here’s a breakdown of who’s facing the steepest penalties, and why some key allies like Canada and Mexico are exempt.

On Wednesday, April 2, or as President Trump calls it “Liberation Day”, America announced reciprocal tariffs by increasing US duties to match the tax rates charged by other countries on American imports. Here’s a list of countries facing reciprocal tariffs.

On April 2, dubbed “Liberation Day” by President Trump, the U.S. will impose new “reciprocal” tariffs on imports, escalating trade tensions with key partners.

While countries like China, Mexico, and Canada are already expected to be hit hardest, many European and Asian economies will likely see a huge impact, prompting global warnings of retaliation, trade wars and a global economic slowdown.

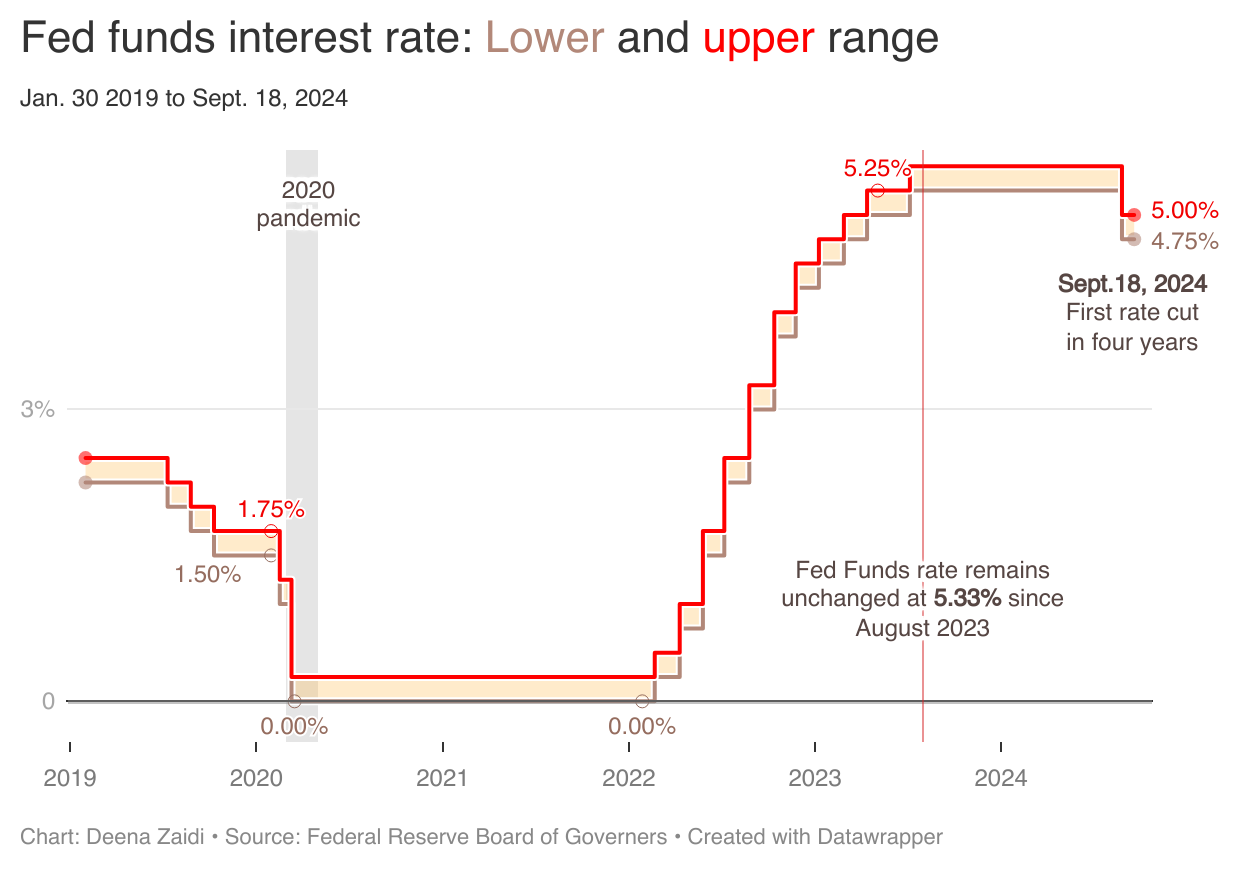

The Federal Reserve keeps its interest rate unchanged, maintaining its target range at 4.25% to 4.5%. When the Fed sets a target for interest rate, it commits itself to adjusting the money supply. To lower the Fed Funds rate, the Fed’s bond trades buy government bonds, increasing the money supply which in turn lowers the…

Canada hits back with tariffs as Trump moves forward with 25% tariff on two of its largest trading partners-Canada and Mexico.

The European Union (EU), America’s third-largest trading partner, retaliates after Trump unveils a 25% tariff on EU imports, a move that could drive inflation and escalate global trade tensions.

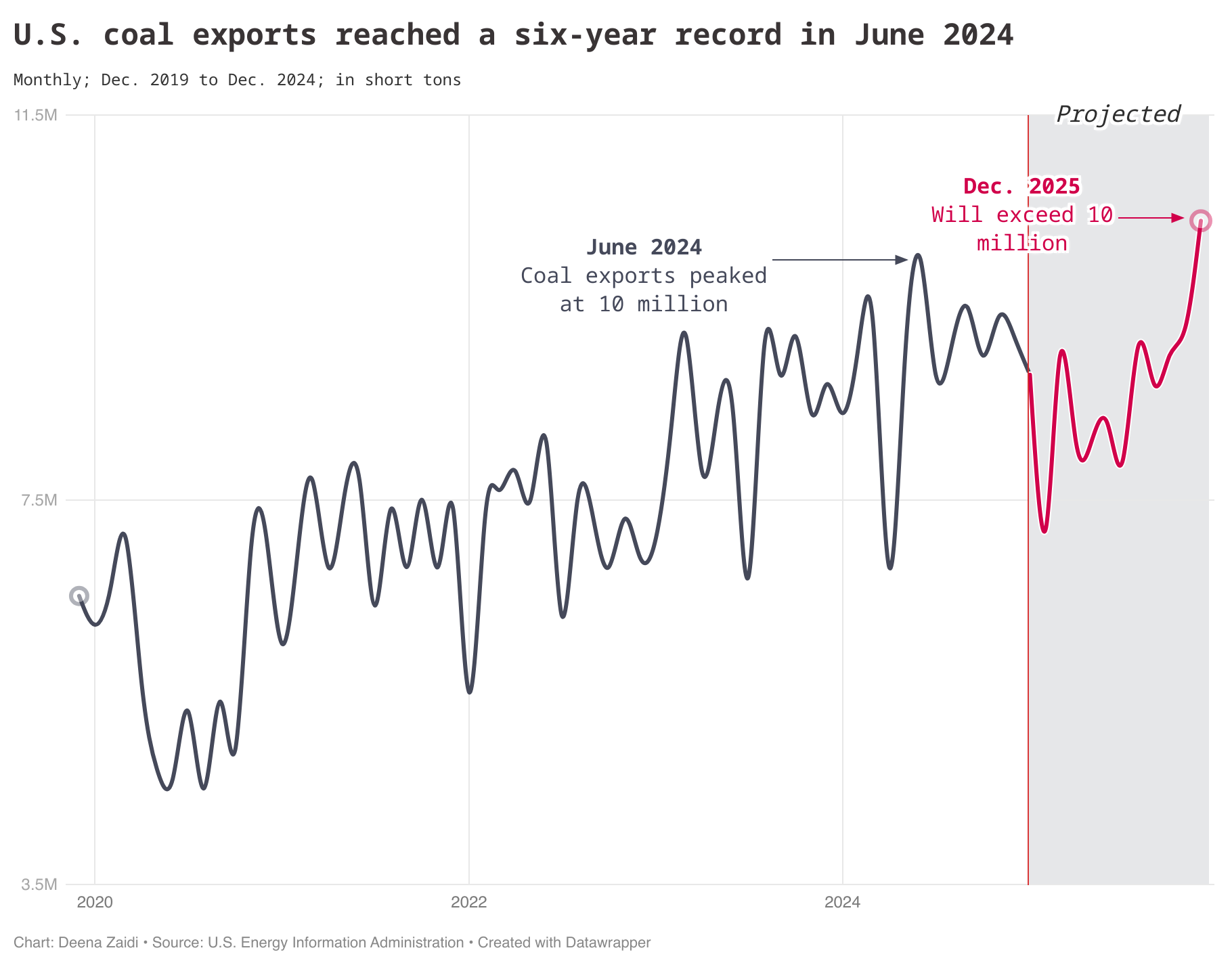

As China retaliates with a 15% tariff on U.S. coal, India remains the top buyer, highlighting shifting global trade dynamics amid ongoing U.S.-China tensions.

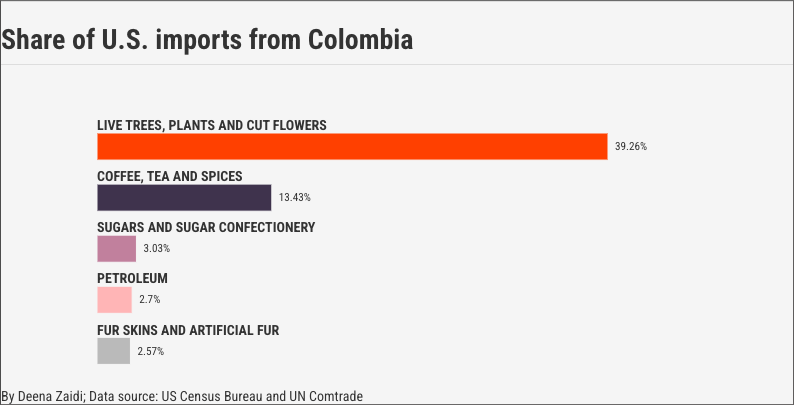

Trump’s second presidency has come with a series of executive actions—most with the focus to make the country more self-reliant, reducing dependence on foreign economies. I delve into the data to uncover how these tariffs might impact the U.S.

A visual explainer on the federal spending and deficit- in five graphs

Trump’s second presidency comes with a series of executive actions—most focusing on making the country more self-reliant, and reducing dependence on foreign economies. We delve into the data to uncover where China, Mexico, and Canada really stand as key trading partners of the U.S. — all in just 3 charts

Less than 1% (0.5% ) of total U.S. imports are from Colombia. But, 28% of Colombia’s imports come from the U.S. The breakdown underscores Colombia’s role as a key supplier of niche products to the U.S. market.

In his second presidency, Trump has repeatedly mentioned taking Greenland from Denmark and retaking the Panama Canal.Together, these trade routes underscore the complexities of international cooperation, climate change, and economic interests shaping the future of global commerce. I take a deep dive into the what’s behind these trade routes and why countries like the U.S., China and Russia are interested in them.

A widespread outbreak of H5N1 is disrupting the egg supply and causing egg prices to rise again. And climate change is partly to be blamed.

The Fed’s interest rate decision on Thursday coincides with the electoral victory of Donald Trump, who won both the popular and Electoral College votes in a strong political comeback in U.S. history, with promises of lowering inflation.

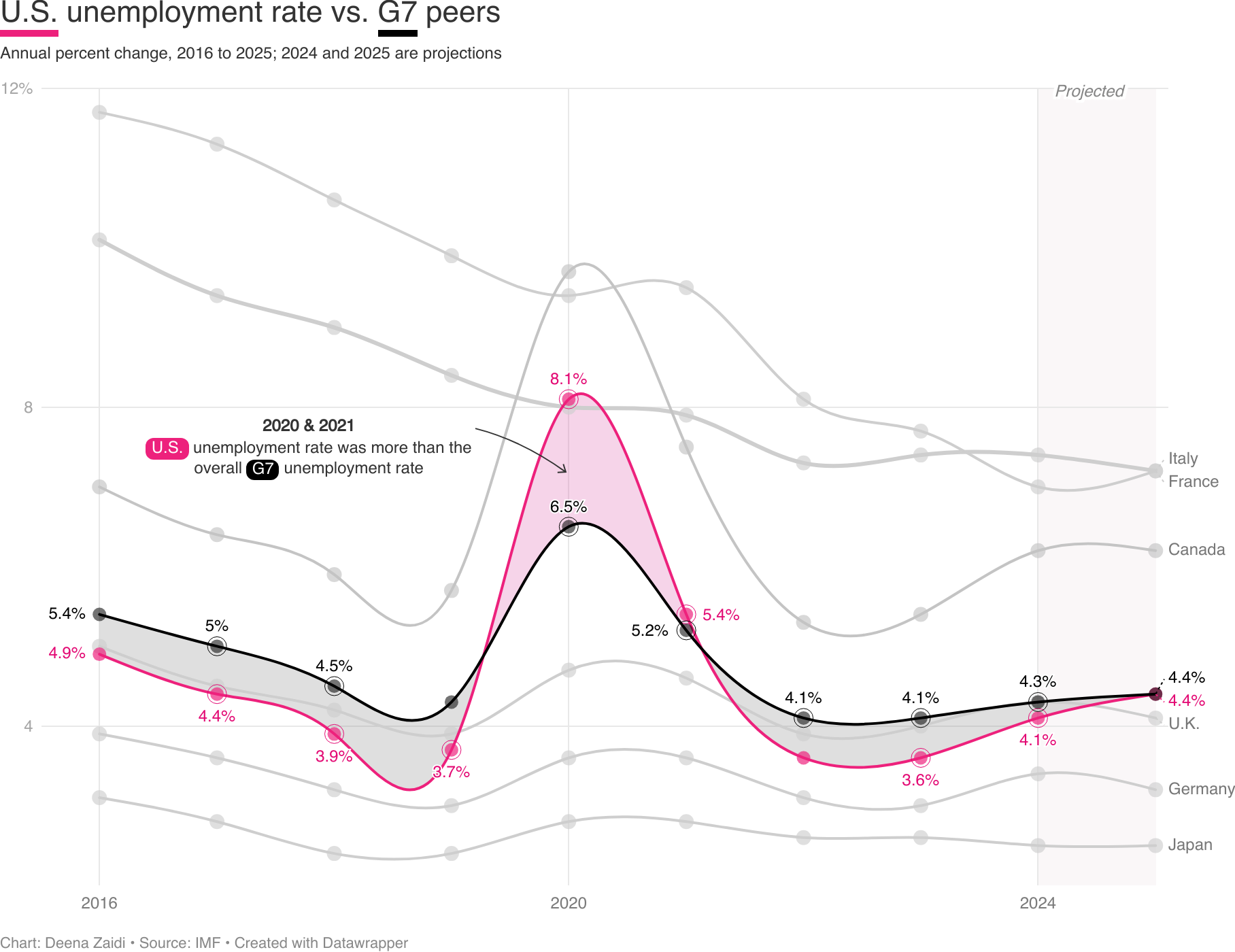

The IMF forecasts rising unemployment rates in 2024 and 2025 for G7 countries, driven by significant increases in the U.S. and Canada, despite initial declines since the 2020 pandemic.

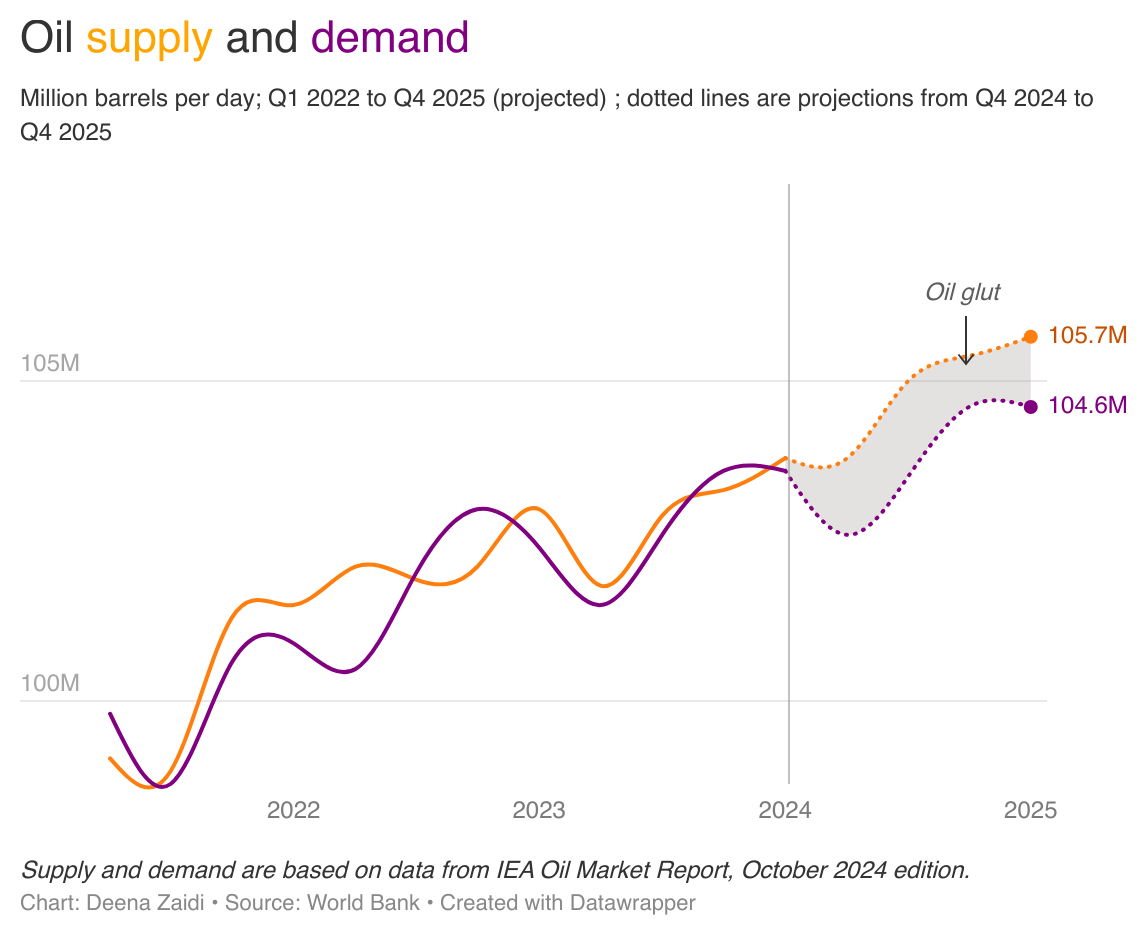

Global commodity prices are set to tumble to a five-year low in 2025 amid an oil glut—so large that it is likely to limit the price effects even of a wider conflict in the Middle East

Central bank purchases have been key in driving up gold, often considered a haven in times of uncertainty and turmoil. Global uncertainties and the Federal Reserve slashing interest rates this year giving bullion a lift.

The Federal Reserve lowered interest rates for the first time since 2020.

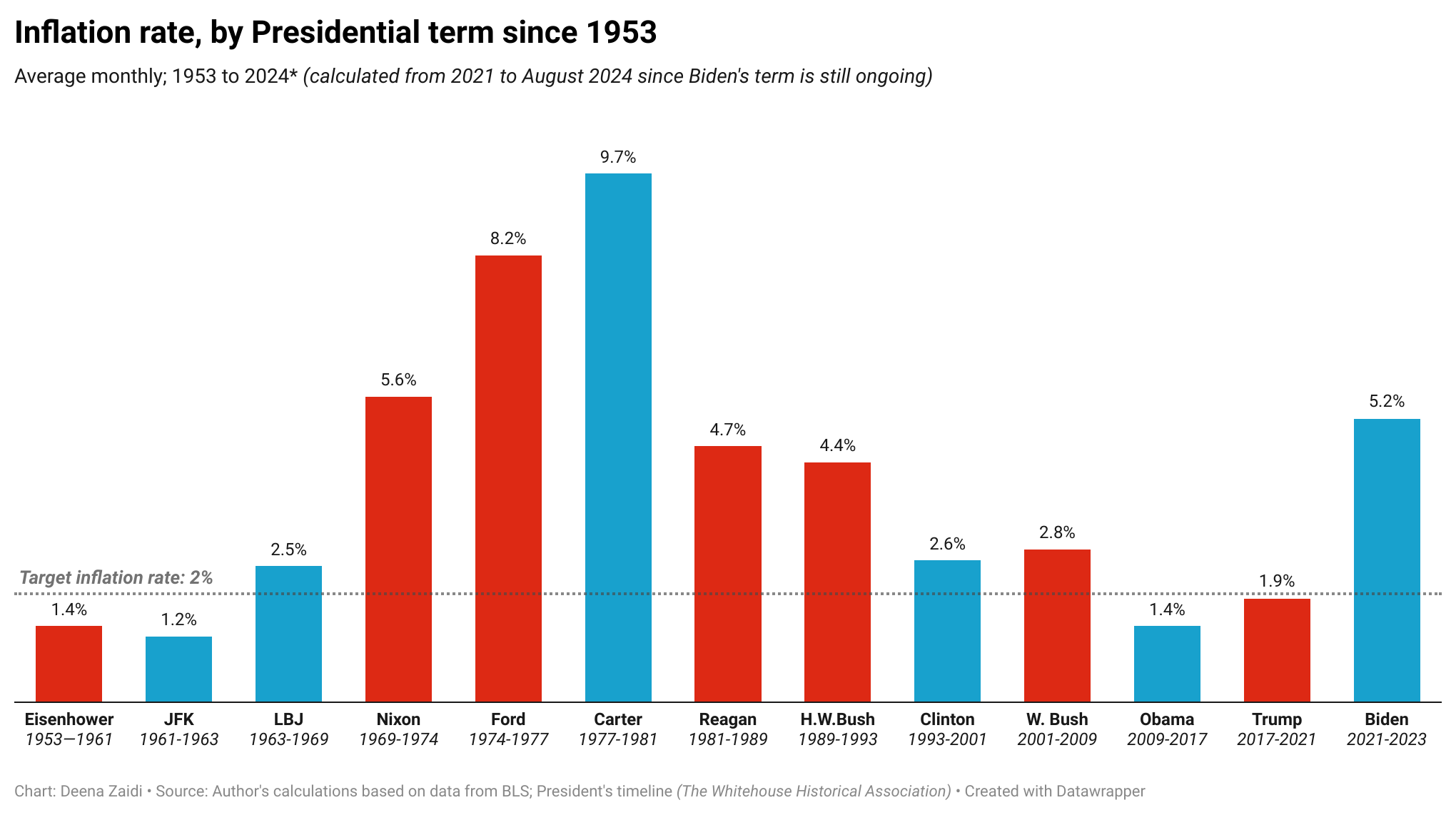

Inflation drivers are often complex and it’s essential to understand that new presidents often inherit economies, shaped by their predecessors.

Both party nominees, Donald Trump and Kamala Harris made some interesting claims about the U.S. economy in their first televised Presidential debate. The U.S. economy remains a heated topic during presidential debates and a top concern for American voters. Eight in ten registered voters say it will be important to their vote in the 2024…

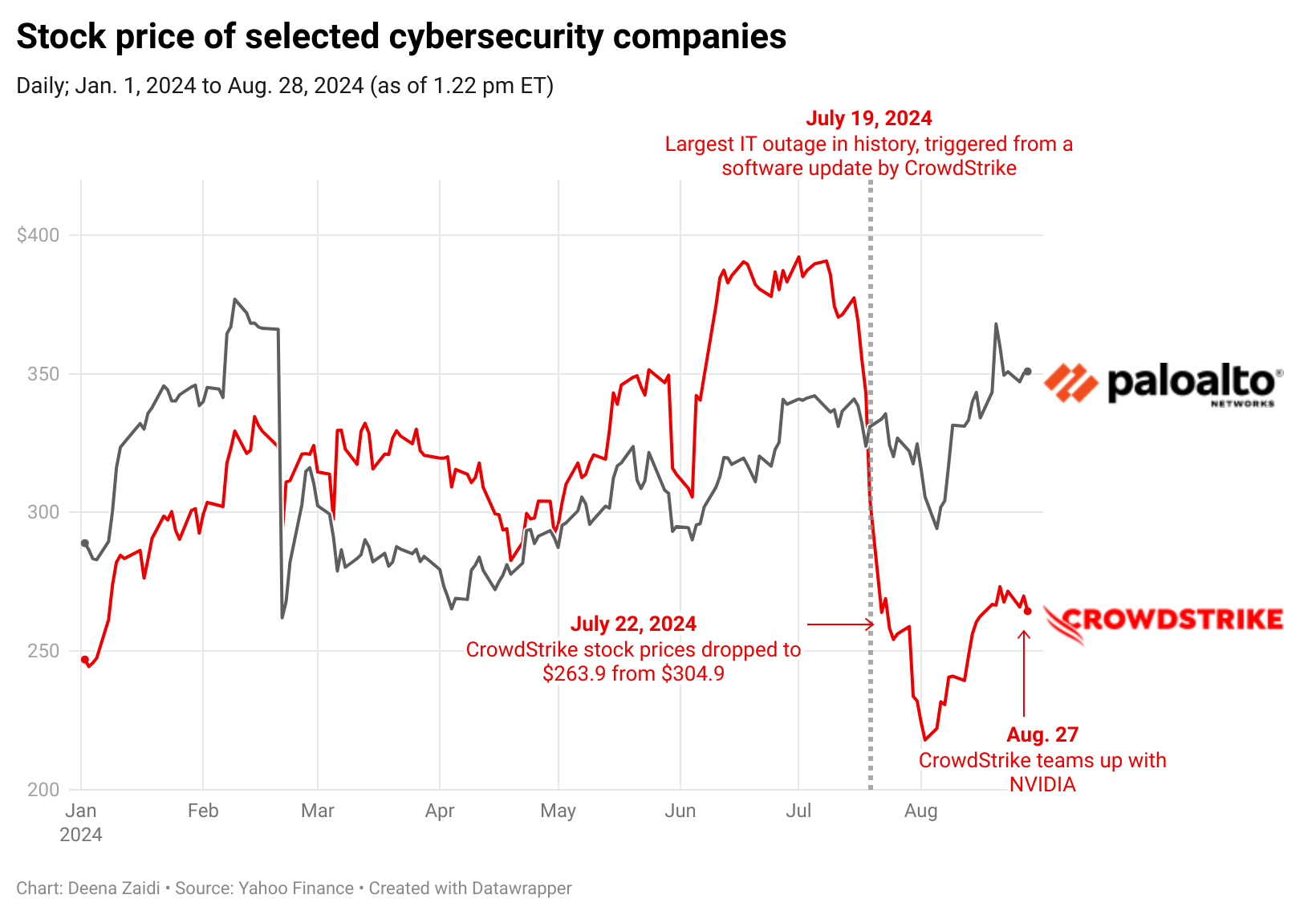

After the global computer outage on July 19 this year, that cost Delta Airlines (DAL) an estimated revenue loss of $500 million, CrowdStrike (NASDAQ: CRWD) is set to reveal its second-quarter earnings. CrowdStrike and NVIDIA: A day before the earnings reports of both CrowdStrike and NVIDIA (NVDA) on Aug. 28, 2024, CrowdStrike announced it will…

Nvidia’s dynamic growth is centered around the surge in demand for AI chips. But others might be catching up to provide stiff competition to the company.

The World Uncertainty Index, tracking uncertainty globally via text-mining Economist Intelligence Unit country reports, indicates ongoing instability due to events like the global financial crisis, COVID-19, and geopolitical tensions, with recent years seeing military conflicts escalating

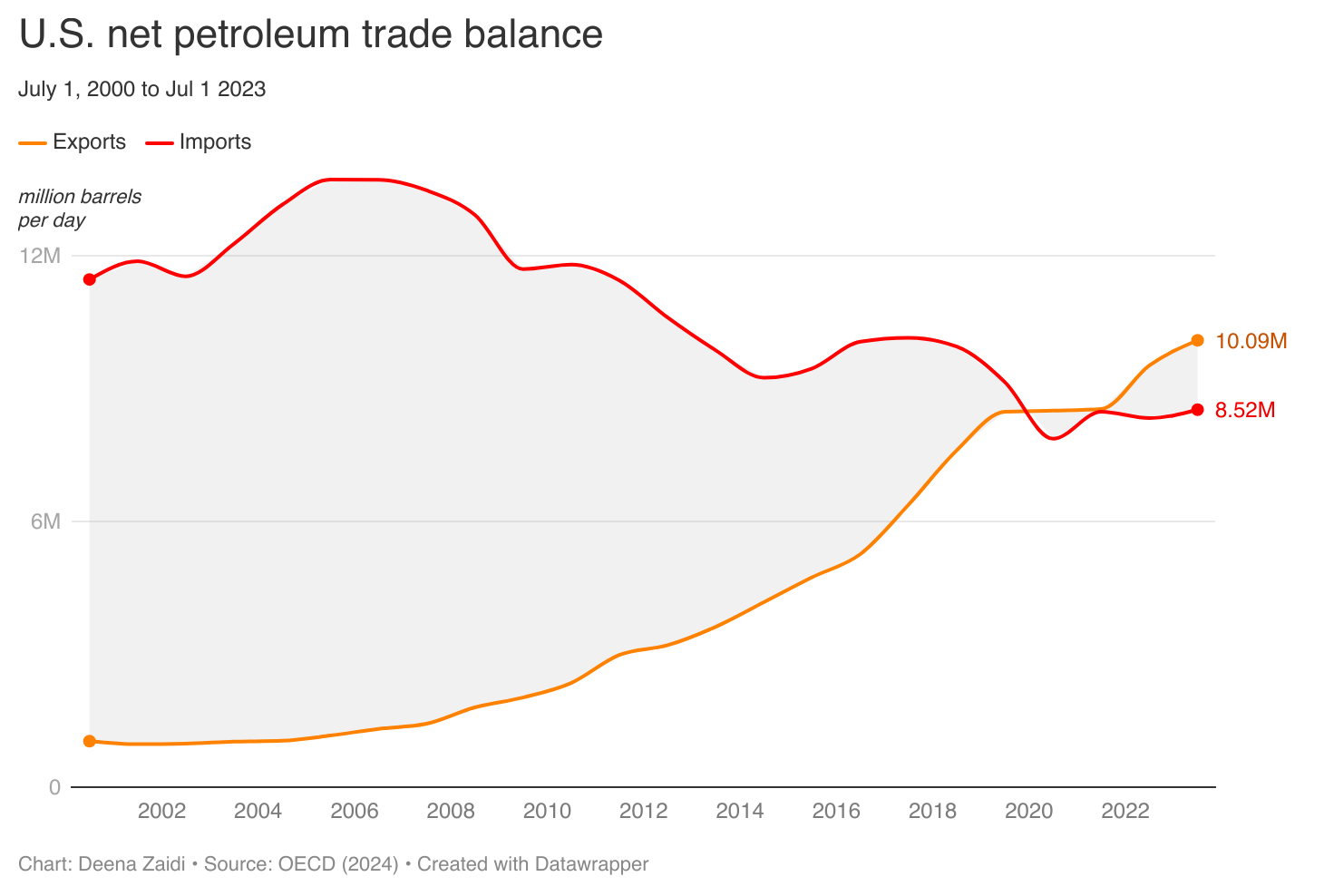

In the second half of 2023, international factors supported economic growth, with exports boosting GDP despite a strong dollar. US petroleum exports hit record highs, making the U.S. a net exporter, but trade with China dropped, with imports falling 20% and exports down by nearly 5%. As of July 1, 2023, U.S. petroleum exports exceeded…

The Federal Reserve uses interest rates as one of the many monetary policy tools to keep inflation at 2% and ensure full employment. Here’s how the terms in this relationship typically work: The relationship between the two can be summarized as follows: Lag Effect: Changes in the federal funds rate don’t immediately impact inflation. There’s…

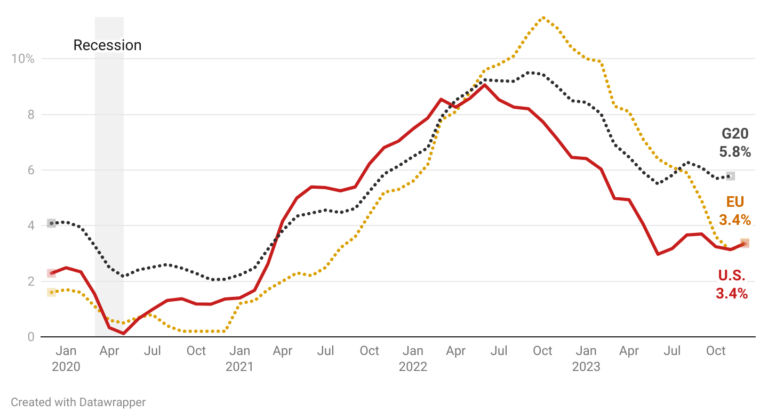

G20 comprises Argentina, Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, Mexico, Russia, Saudi Arabia, South Africa, South Korea, Turkey, the U.K. and the U.S., as well as the European Union, represented by the rotating council presidency and the European Central Bank. In June 2022, both U.S. and G20 inflation reached 9.1%, according…

Inflation is a key economic indicator that impacts consumers, businesses, and policymakers. Understanding inflation trends in G-7 countries provides a snapshot of the complex and interconnected global economic landscape. The G-7 consists of some of the world’s most advanced economies, including the U.S., Canada, Japan, Germany, France, the U.K. and Italy. Let’s delve into the…

Wall Street is looking towards Silicon Valley for a more automated environment and a tech-driven approach. A July 2016 report by CB Insights showed that 41 startups may be introducing AI to fintech. Of the many big names, Goldman Sachs remained dominant in backing as many as four companies that use AI in financial technology.…

Faced with unprecedented challenges, banks have started racing to embrace AI to gain a competitive advantage. With the advent of chatbots, personal assistants, and robo-advisors, it may not be too hard to imagine that the next wave of technology could revolutionize the traditional style of banking. An Accenture report recently indicated that within the next three years, banks will deploy…

Banks have always remained too big to fail but their systemic risk became the topic of debates after the 2008 financial crisis. Living wills are a part of the post-2008 reforms to ensure that the risk does not spread to other sections of the financial system.

Volcker Rule is a temporary solution to a permanent problem of ‘too big to fail’. If Volcker Rule really aims to address the issues of 2008 financial crisis, it should eliminate the issue of ‘too big to fail’ because as long as large firms exist, they will continue to attract federal support during any future crisis, despite all the adherence to the strict rules in the Dodd-Frank rulebook.

With many complexities and delays, the promise made by Dodd-Frank is yet to be delivered. The above-mentioned rules are only three rules of the 400 ones that make up the Dodd-Frank Act. Here are the missing links of the Dodd-Frank Law.

Over a quarter of global seaborne oil flows through the Strait of Hormuz—making Asia’s top economies especially vulnerable to any disruption.